12 Boldest Web-Based Scams of 2025: Cases You Didn’t Knew About

Scammers in 2025 leaned on artificial intelligence, social platforms, and the gaps in digital payments to scale fraud faster than ever. This article lists 12 web-based and online scams that actually occurred in 2025, explains how each worked, and gives concrete data, real-world signals, and prevention steps you can use right now.

What were the most damaging online scams in 2025?

1. Celebrity deepfake ad networks

In October 2025, Brazilian authorities dismantled a scam network that had been using deepfake videos of supermodel Gisele Bündchen to lure unsuspecting victims on Instagram. The fraudsters promoted fake giveaways and investment schemes that tricked users into paying small “shipping fees” or buying products that never arrived. Over 20 million reais (about US$3.9 million) were siphoned through thousands of microtransactions, making the operation highly profitable.

This case shows how convincing AI-driven celebrity impersonations can be. As Reuters reported, many victims didn’t even realize they were scammed, since the amounts were so small. But at scale, these deepfake-powered ads turned into one of Brazil’s most lucrative fraud operations of 2025.

How it worked: Scammers amplified their reach with paid ads, convincing celebrity faces, and checkout pages that harvested card data.

How to prevent it: Always verify the seller’s domain, and never pay shipping fees for “free prizes.”

2. Deepfake CEO impersonation scams

In Singapore, a multinational finance director fell victim to a sophisticated deepfake impersonation scam. During a Zoom call, attackers generated real-time AI videos of the company’s CEO and CFO, ordering him to wire funds for a “confidential acquisition.” He complied, sending US$499,000 to Hong Kong accounts. A second transfer of US$1.4 million was only stopped after the employee grew suspicious.

Singapore police, working with Hong Kong authorities, managed to recover much of the money. The Mothership report highlights how criminals now combine business email compromise with live deepfake meetings, making it one of the most dangerous trends in 2025.

How it worked: The combination of video conferencing and urgent financial instructions created a convincing scenario.

How to prevent it: Require out-of-band confirmations and multi-person signoffs for high-value transactions.

3. Crypto rug pulls & Investment Scams

In Delhi, India, police arrested Dharmendra Kumar, known as “Daddki,” for masterminding a nationwide fake investment scheme. Using WhatsApp and Telegram groups, he promised huge returns through bogus stock tips, IPO subscriptions, and crypto investments. One victim lost nearly ₹2 crore (~US$240,000), and investigators recovered over ₹1.8 crore from his accounts.

According to Times of India, Kumar had been running similar frauds for years. The case underlines how fraudsters now use encrypted messaging apps and payment gateways to launder funds, making detection harder.

How it worked: Anonymous teams hyped unverified projects, pulled liquidity, and vanished.

How to prevent it: Stick to audited projects, avoid anonymous founders, and never invest more than you can afford to lose.

4. AI voice cloning scams

In early 2025, Italy witnessed a sophisticated scam where cybercriminals used AI-generated voice cloning to impersonate high-ranking officials. One notable incident involved scammers mimicking the voice of Defence Minister Guido Crosetto, targeting prominent business leaders. The perpetrators claimed that Italian journalists had been kidnapped and urgently needed ransom funds. Victims, including fashion designer Giorgio Armani and entrepreneur Patrizio Bertelli, were convinced to transfer large sums of money to foreign accounts. In one case, a businessman wired nearly €1 million before realizing it was a hoax. Authorities managed to freeze the funds in the Netherlands, preventing further losses. Reuters

The scammers employed advanced AI technology to replicate Crosetto’s voice, making the calls appear authentic. They also spoofed official government numbers and used deepfake audio, adding layers of credibility to their demands. This incident underscores the potential dangers of AI in facilitating scams that exploit trust and authority.

How it worked: Short audio samples were enough for AI to generate convincing speech.

How to prevent it: Use a family “safe word” or ask personal questions only the real person would know.

5. QR code phishing scams

QR code fraud also struck in Thiruvananthapuram, India, where staff at a popular café owned by influencer Diya Krishnakumar allegedly swapped out the official payment scanner. Over time, payments amounting to ₹69 lakh (US$80–90,000) were siphoned into fraudulent accounts.

Police said multiple employees were involved, and CCTV evidence confirmed the manipulation. Times of India reported that the fraud ran for months before detection. It’s a sharp reminder that even legitimate shops can be hijacked by insider scams.

How it worked: QR scanning bypasses suspicion because it feels seamless.

How to prevent it: Only scan QR codes from trusted sources and preview the URL before entering credentials.

6. Fake online marketplaces

In July 2025, researchers uncovered a network of over 4,000 fraudulent e-commerce domains dubbed “GhostVendors.” These websites impersonated trusted retailers like Amazon, Costco, and Nordstrom, often advertised through Facebook Marketplace. Victims clicked on “flash sales” and paid for products that never shipped.

As Cybernews revealed, the GhostVendors scheme relied on black-hat SEO to rank highly in Google searches, tricking bargain-hunters. Once exposed, scammers abandoned the domains and resurfaced under new names, keeping authorities chasing shadows.

How it worked: Sites cloned legitimate e-commerce branding and fabricated customer reviews.

How to prevent it: Pay with credit cards that allow chargebacks and check a domain’s age before making large purchases.

7. AI-powered phishing campaigns

In mid-2025, cybersecurity firms reported a surge of phishing emails crafted by large language models that referenced recent company events, personalized spending patterns, or internal jargon. One targeted campaign used emails that looked like corporate expense reports, citing exact vendor names and amounts from real credit card statements. Victims clicked a link believing it was legitimate and had their credentials stolen.

Another major IT firm was nearly compromised when an internal executive’s style was mimicked using AI to write a fake “urgent update” message. The email contained a link to a malicious CAPTCHA overlay that harvested credentials. Security teams detected anomalies in email behavior and stopped it before mass damage.

In both incidents, the blend of AI text generation plus real data (breach leaks, public info) amplified trust. Attackers no longer needed to write from scratch, they could prompt LLMs to assemble hyper-targeted phishing with few mistakes. Defenders now warn that even advanced filters struggle when attackers combine personal context with generative models.

How it worked: The emails mirrored real templates and included accurate personal details.

How to prevent it: Hover over links before clicking, use strong spam filters, and enable multi-factor authentication.

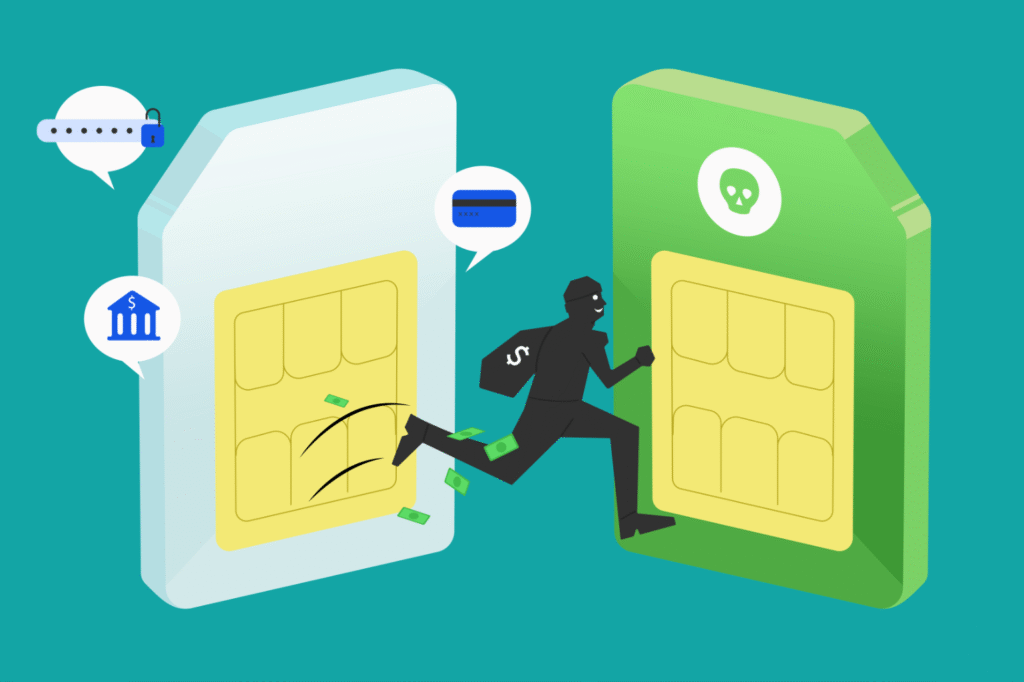

8. SIM swap fraud targeting crypto and banking

In 2025 the U.S. Department of Justice filed motions to seize over $5 million in Bitcoin tied to SIM-swapping attacks that enabled thieves to bypass SMS-based 2FA and drain victims’ crypto wallets. The stolen funds migrated through gambling and exchange platforms to obscure the trail.

These SIM swap schemes often begin with social engineering or identity harvesting: attackers collect personal data, then impersonate the victim when contacting the mobile carrier to port the phone number to their SIM. Once successful, they intercept OTPs and reset banking and crypto passwords. Because crypto transfers are irreversible, this method remains very lucrative.

The $5 million forfeiture signals that even large scale schemes are now on law enforcement’s radar. But many smaller victims never report. Security experts advise switching from SMS 2FA to authenticator apps and securing your mobile account with PINs or extra authentication layers.

How it worked: Attackers exploited weak mobile carrier protections to bypass two-factor authentication.

How to prevent it: Use authenticator apps, add a PIN to your mobile account, and monitor for sudden loss of service.

9. Fake remote job offers

Remote work scams rIn Pune, India during 2025, a man answered what seemed like an attractive online job posting and was persuaded to pay a “training deposit” of ₹22.65 lakh (approx US$27,000) before being ghosted. The recruiting agency vanished and the victim’s documents were used in identity fraud.

Meanwhile, U.S. authorities flagged a text-message campaign that sent unsolicited job offers claiming “work from home – instant earnings.” Recipients were told to pay into a cryptocurrency wallet to process their “onboarding.” The New York Attorney General publicly warned that paying up front is a clear red flag.

In both scenarios, scammers rely on the appeal of remote work and the urgency or too-good-to-be-true promises. Usually they collect personal identity documents or payment, then vanish. Always verify job postings through official company sites, demand zero upfront fees, and check for legitimacy before trusting.

How it worked: Professional-looking career pages and fake recruiter profiles built trust.

How to prevent it: Verify job openings on official company websites and cross-check recruiters on LinkedIn.

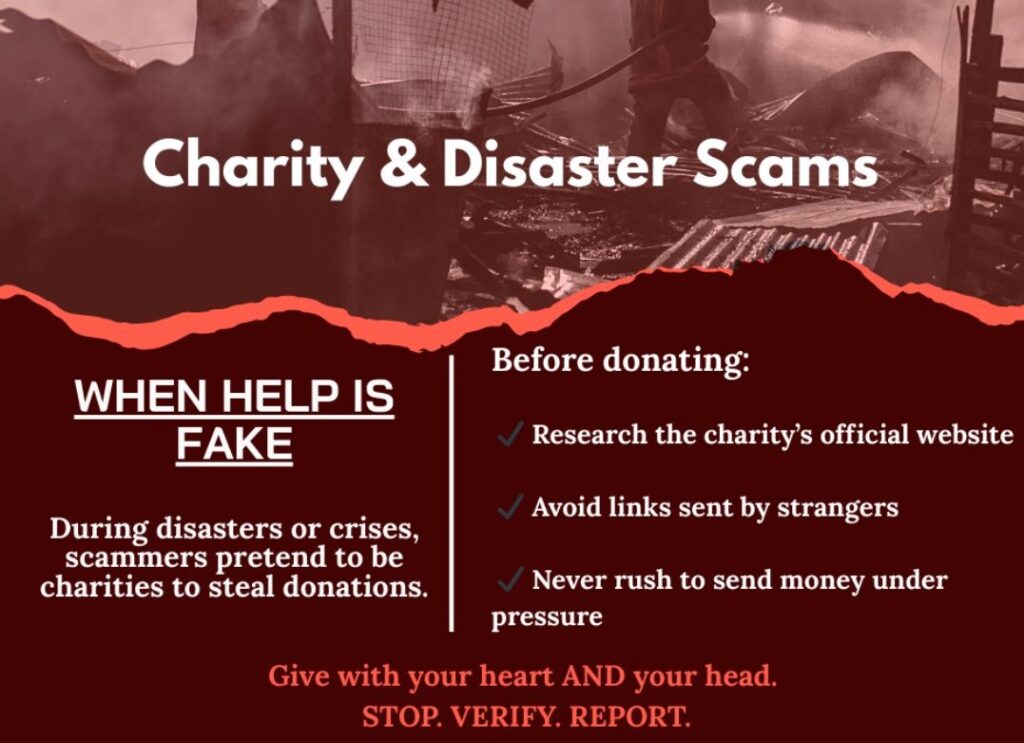

10. Fake charities after disasters

After floods struck Texas in 2025, state officials flagged dozens of phony donation websites impersonating well known relief organizations. Many used similar domain names and logos, collecting funds in crypto wallets that could not be traced. The Attorney General’s office launched an investigation into payment processors used by the fake sites.

In India, Mumbai police arrested a ring accused of using fake charity fronts claiming they’d build shelters or provide disaster relief. They took in roughly ₹24 crore (tens of millions of BTC equivalent) through shell accounts, promising donor tax benefits and official receipts. The group is under prosecution for large-scale fraud.

These cases illustrate how disasters create emotional urgency. Fraudsters exploit that by launching imposter charities just when attention is highest. To protect yourself: donate only via verified charity websites, check registration numbers, and avoid giving to unknown pages especially if they demand cryptocurrency or immediate wire transfers.

How it worked: Scammers exploited public sympathy and trending crises.

How to prevent it: Donate directly through verified charity websites or government registries.

11. Influencer giveaway shipping fee scams

Throughout 2025, many Instagram and TikTok users reported winning “free” contests, only to be told they must pay a small shipping or handling fee via a payment link. The promised prize never arrives. These scams use cloned or fake influencer accounts to gain trust.

Some giveaway scams became so widespread they triggered alerts from security firms. Victims often paid small amounts (e.g. $5–$25), making individual reporting unlikely, but cumulatively, the revenue is large. The scam works because people feel they are getting something free and the fee seems trivial.

Security advisors now warn: if an influencer asks you to pay to claim a prize, it’s almost certainly a scam. Check the influencer’s verified page, search for previous giveaways, and never enter credit or debit card info to claim something you supposedly already “won.”

How it worked: Cloned influencer accounts boosted trust while low-value requests discouraged suspicion.

How to prevent it: Confirm giveaways on the influencer’s verified page and avoid paying fees for prizes.

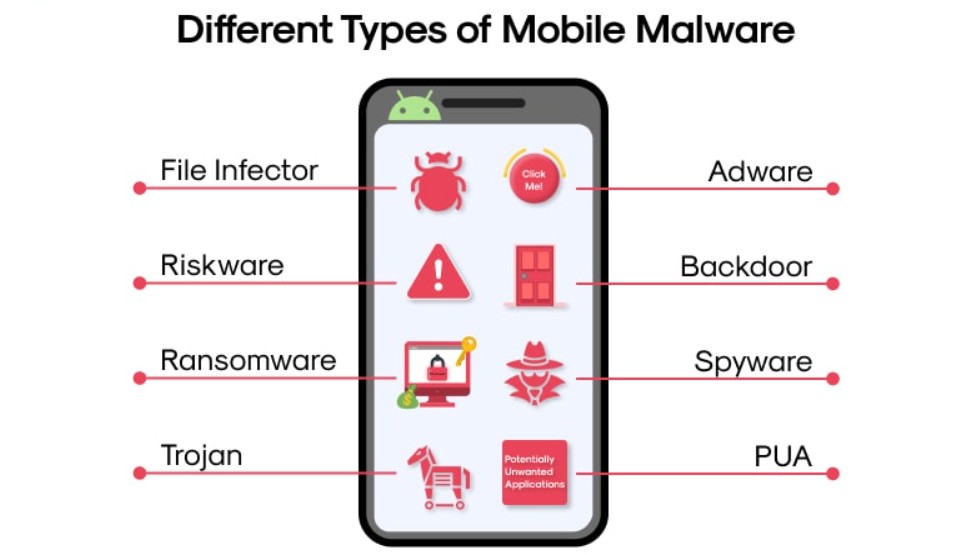

12. Malicious mobile apps

In 2025 cybersecurity researchers uncovered an Android trojan named Klopatra which masqueraded as VPN or IPTV apps. Once installed, it requested accessibility permissions, overlaid screens on banking or crypto apps, and silently drained wallets. The malware was distributed outside official app stores across Europe.

Also in 2025, the Anatsa / TeaBot banking trojan reemerged, this time bundled into decoy apps that looked like productivity or utility tools. Victims installed them thinking they were legitimate, then had credentials siphoned or funds stolen once the app activated. Some estimates show millions of impressions before detection and removal.

These cases highlight how malicious apps can exploit lax distribution channels and permission abuse. Always download apps from official app stores, check reviews and permissions, and use mobile antivirus tools. If a new app asks for extensive rights (accessibility, overlay), treat it with suspicion.

How it worked: Apps requested excessive permissions and hid malicious code inside overlays.

How to prevent it: Download apps only from official stores and review requested permissions carefully.

Quick comparison of major scams in 2025

| Scam Category | Attack Vector | Risky Action |

|---|---|---|

| Deepfake ads | AI video | Paying shipping fees or entering card data |

| CEO fraud | Video calls | Authorizing urgent wire transfers |

| Crypto rug pulls | Token launches | Investing in anonymous projects |

| SIM swap | Mobile carriers | Relying on SMS-based 2FA |

| AI phishing | Emails | Clicking malicious links |

Practical tips to stay safe

- Use authenticator apps instead of SMS for login security.

- Double-check all urgent money requests with a phone or video call.

- Educate family members about AI voice scams.

- Verify domains, URLs, and app permissions before trusting.

- Report scams to platforms quickly to protect others.

Final thoughts

Scammers in 2025 took full advantage of AI tools and digital payments to create more convincing schemes than ever. From deepfake CEO fraud to QR phishing and crypto rug pulls, the tactics may evolve, but the fundamentals remain the same: exploiting trust and urgency. Staying skeptical, verifying sources, and strengthening account security are still your best defenses.

FAQs

What was the most common scam in 2025?

How did deepfake scams evolve in 2025?

Were crypto investors safer in 2025?

Can SIM swap scams be prevented?